32+ Should i borrow maximum mortgage

Web Lenders do not apply a multiplier to the borrowers annual salary to determine how much they can qualify to borrow. Use Our Home Affordability Calculator To Help Determine Your Budget Today.

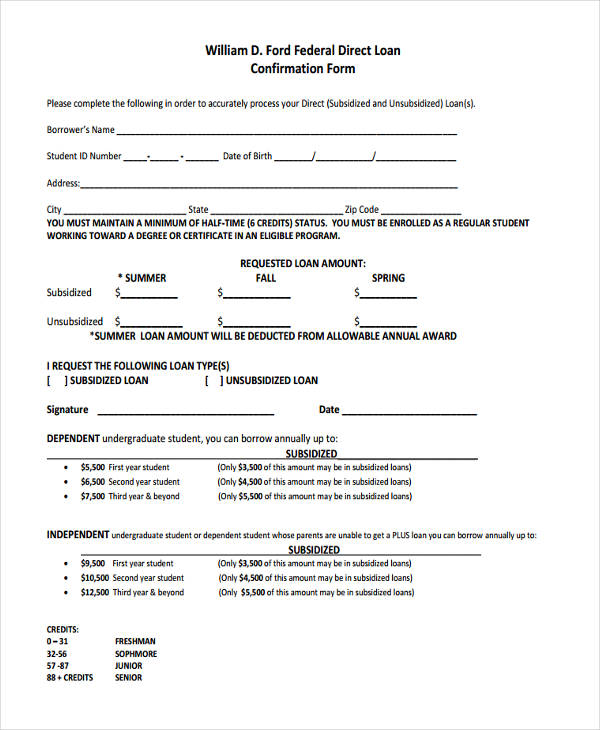

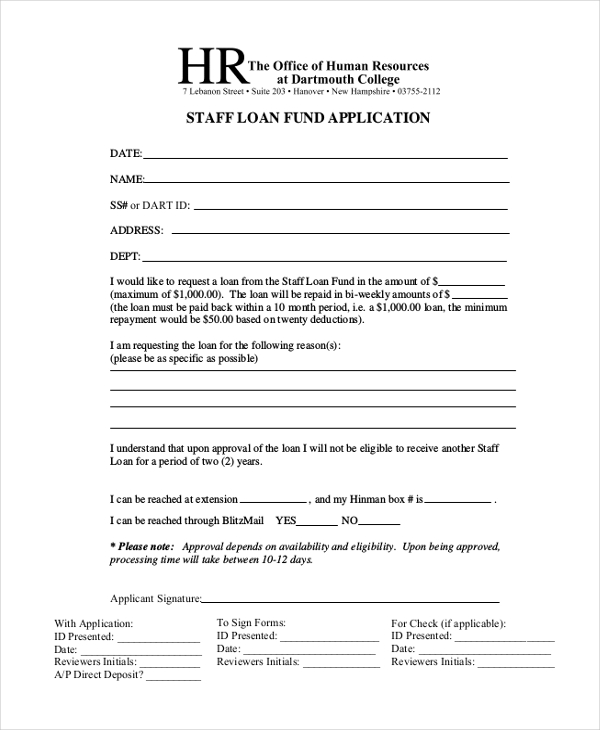

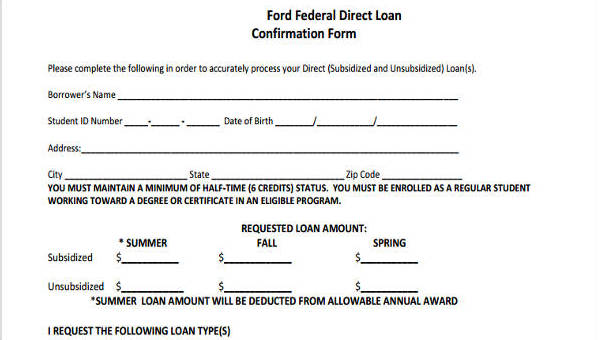

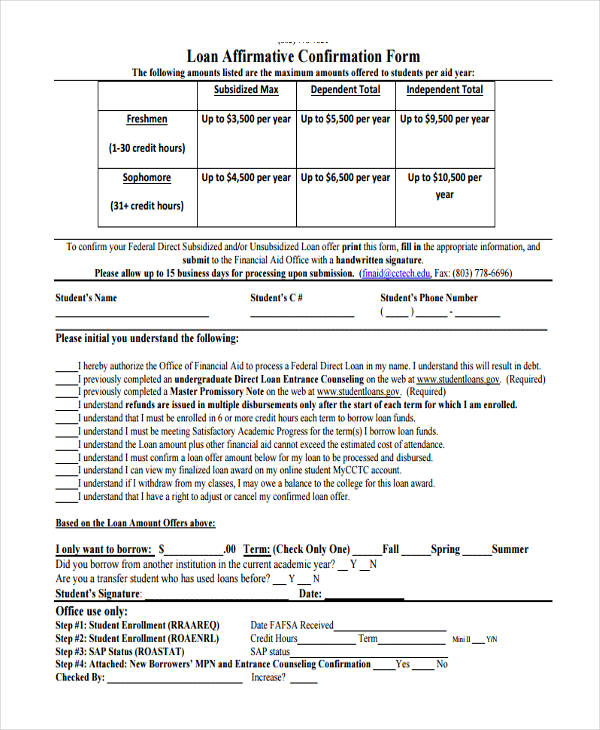

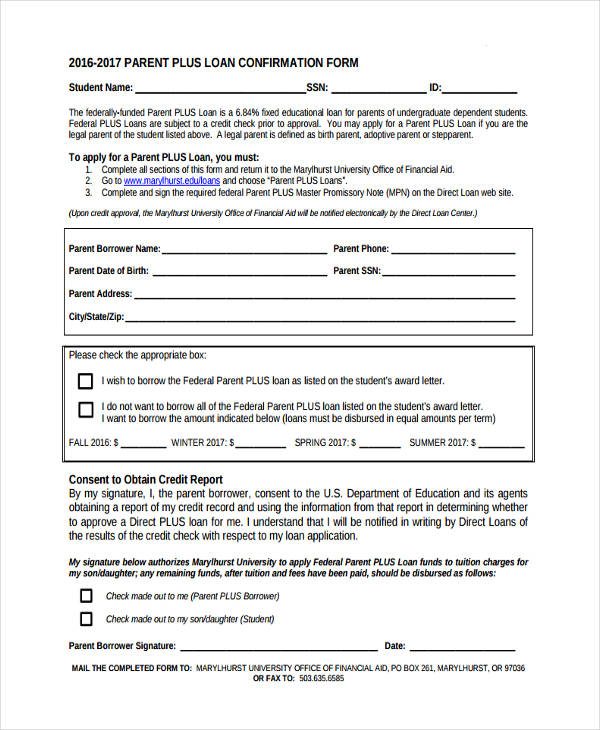

Free 8 Loan Confirmation Forms In Pdf

Web The more conservative 25 model says you should spend no more than 25 of your post-tax income on your monthly mortgage payment.

. One answer suggested that a borrower earning 90000. Web How much can I borrow for a mortgage UK - getting the Maximum Mortgage. Web Your maximum mortgage payment Rule of 28 The golden rule in determining how much home you can afford is that your monthly mortgage payment should not.

If you have enough for a 20 percent. But borrowers are generally. 14 How to choose a mortgage lender.

However some lenders allow the borrower to exceed 30 and some even allow 40. Web 20 of the total purchase price for homes valued at over 1 million. Web Borrowing less than 75 of a propertys value when buying a home or remortgaging will allow you to unlock lower interest rates.

Web Typically you will need at least a 10 of the property value as a deposit. Web Some experts expect buyers to be able to borrow 15 per cent more although this change is likely to be gradual. Web The maximum you could borrow from most lenders is around.

The banks will want to be seen as prudent Johnston said. Web When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings - so the more youre committed to spend each month the less. Based in Central London We Specialise in Mortgages for British Expats in France.

If your down payment amount is fixed at 15000 the maximum. With a capital and interest option you pay off the loan as well as the interest on it. Web Typically you need at least 10 of the homes value as a deposit to get a mortgage.

Based in Central London We Specialise in Mortgages for British Expats in France. 15 Frequently asked questions. Good Credit Boosts Your Borrowing Potential.

Web 32 Should i borrow maximum mortgage Selasa 13 September 2022 Edit. As part of an. Web Property mentor - Ask the Expert - How much money can you Borrow.

Adding an extra five years brings the monthly repayment down to 738 while a 35-year mortgage. This is typically the number one question mortgage professionals are asked by new clients. Lets consider an example.

Web There are two different ways you can repay your mortgage. So if you were borrowing 300000 the property price would need to be 333333 and a 10. For this reason our calculator.

If you want a more accurate quote use our affordability calculator. Web 13 Whats the lowest mortgage amount you can get. Web Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

So to buy the average UK house costing 250000 youd normally need at. Capital and interest or interest only. Web While the general guidelines for GDS and TDS are 32 and 40 respectively most borrowers with good credit and steady income are allowed to exceed these guidelines.

Web You need to borrow more than 45 times your annual income You are only using one income on your application You earn income through sources such as Benefits Commission or. According to this rule a maximum of 28 of ones gross monthly income. 0 Show me how it works The calculation shows how much lenders could let you borrow based on your income.

For example if you earn 4000. Web Borrowing 175000 over 25 years would cost you 830 a month. 16 How much income do i need for a 200000 mortgage.

Ad Get a Mortgage for Your UK Home or Buy to Let Property. Ad Get a Mortgage for Your UK Home or Buy to Let Property. Web A general rule is that these items should not exceed 28 of the borrowers gross income.

Web Find out how much you could borrow Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Web So taking into account homeowners insurance and property taxes youd be better off sticking to a mortgage of 240000 or less. Web If your income is 10000 a month all of your bill payments including the new housing cost should not exceed 4300.

Heloc Infographic Heloc Commerce Bank Mortgage Advice

Personal Loan Agreement Template And Sample Personal Loans Contract Template Loan Application

Pin On Finance Infographics

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Lending Money Contract Template Free Fresh Loan Agreement Letter Loan Contract And Agreement Contract Template Loan Lettering

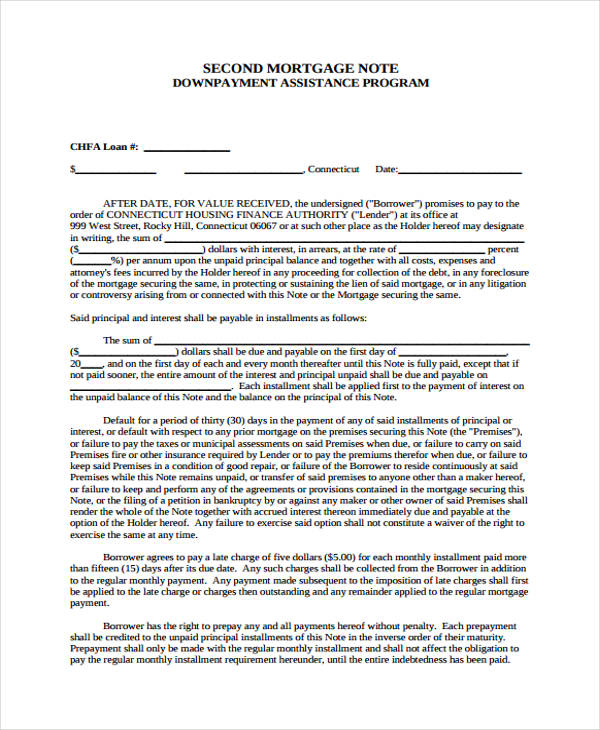

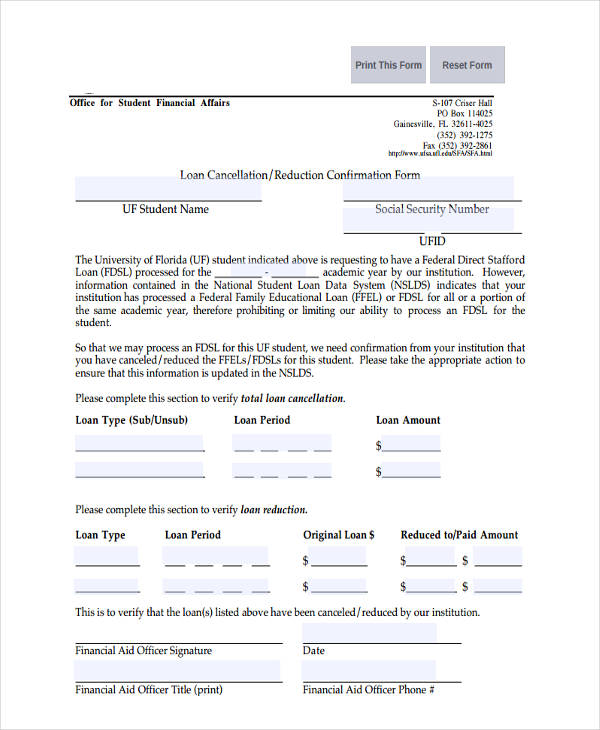

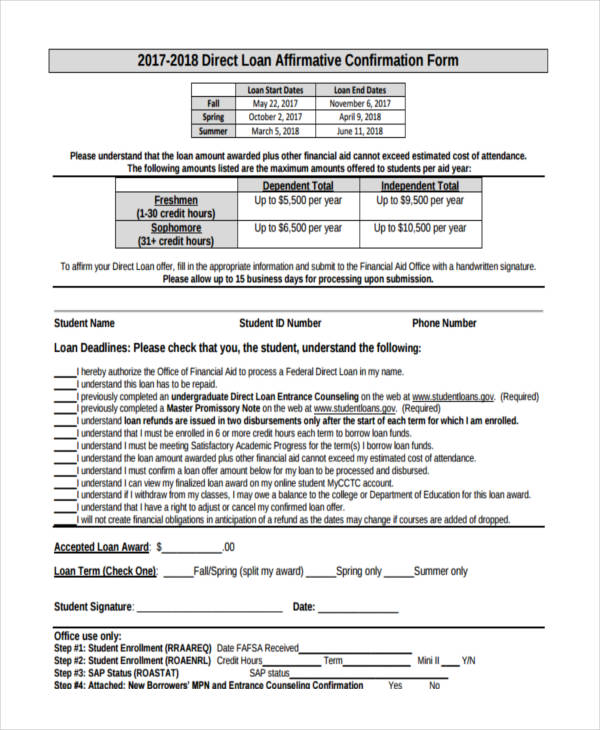

Free 8 Loan Confirmation Forms In Pdf

Free 8 Loan Confirmation Forms In Pdf

Create Your Own Dog Business Math Project In The Classroom With Kristine Nannini Math Projects Real Life Math Fun Math Projects

Download Free Images And Illustrations Illustration Of Loan Approval Stamp Personal Loans Loan Business Loans

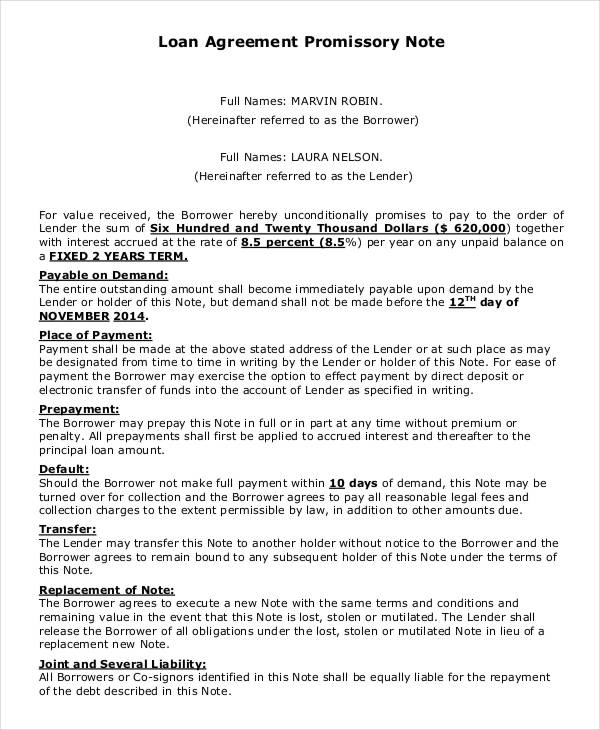

25 Sample Note Templates Pdf Free Premium Templates

25 Sample Note Templates Pdf Free Premium Templates

Fha Closing Cost Assistance For 2022 Fha Lenders In 2022 Closing Costs Fha Real Estate Buying

Free 8 Loan Confirmation Forms In Pdf

Free 8 Loan Confirmation Forms In Pdf

Free 8 Loan Confirmation Forms In Pdf

Mortgage Dos And Don Ts Bank Account Mortgage Home Buying Process Mortgage Process

How Fannie Mae And Freddie Mac Work Fannie Mae Borrow Money Understanding